After exiting a batch of humanoid projects, Zhu Xiaohu invested in an underwater robot.

ChinaVenture has exclusively learned that Seahi Intelligent has announced the completion of consecutive Angel+ and Pre-A rounds totaling 50 million yuan in funding. The Angel+ round was led by China Merchants Group's China Merchants Qihang Capital. The Pre-A round was co-led by GSR Ventures and Yunze Capital, with existing investor Kunshan Angel Fund continuing its participation. Additional investors include Wuzhong Financial Holdings and Anyu Capital, with Anyu Capital serving as the company's long-term exclusive financial advisor.

Seahi Intelligent specializes in underwater general-purpose robotics and intelligent unmanned equipment solutions. Frankly, compared to humanoid robots currently raising hundreds of millions, this funding amount isn't particularly eye-catching. However, the investor mix—spanning industrial capital, financial investors, and local government funds—is noteworthy. Reviewing investor comments reveals a consistent focus on “marine economy,” underscoring widespread optimism toward this frontier sector.

Ironically, just after Zhu Xiaohu publicly announced his “mass exit from humanoid robotics,” he turned around to lead an investment in an underwater robotics company. This echoes a point I made in my article “Sand Hill's Zhu Xiaohu: We Are Massively Exiting Humanoid Robotics Companies”—disliking embodied intelligence, especially concepts like humanoid robots, doesn't mean rejecting the entire robotics sector. Wang Xingxing of Yushu Robotics has shared his perspective on the ultimate fate of humanoid robots, essentially stating that the form of robots is irrelevant to him—the humanoid design exists to align with societal consensus. Should one invest in humanoids? Is this a bubble or merely a wave within a transformative tide? Early-stage investors must ultimately make clear-headed judgments amid the frenzy.

Looking at Seahi Intelligent, the latest investment by Jinshajiang, it perfectly aligns with Chairman Zhu's investment philosophy. The underwater robotics niche isn't particularly crowded. Objectively speaking, hindered by high R&D complexity and slow progress in marine resource development, its past growth has been modest, with limited capital involvement. Yet the marine economy represents a vast market. This year, deep-sea technology—alongside commercial aerospace and low-altitude economy—was explicitly designated as an emerging industry in the Government Work Report. With this policy tailwind, opportunities for domestic substitution have become clear, and commercialization prospects are now well-defined.

First, let's examine the founder's background. From an investor's perspective, Seahi Intelligent's founder fits squarely into the category of “serial entrepreneur.”

Chen Xiaobo, born in the 1980s, graduated from Harbin Engineering University and Northwestern Polytechnical University. Those familiar with the field know these are top-tier institutions in underwater robotics. He is the type who found his life's mission early on, moving forward with strong goal-oriented determination. He studied communications and electronics as an undergraduate but switched to navigation manufacturing and control for graduate studies to tackle control and navigation challenges in underwater robots. Describing this career trajectory as “promising at a young age” is no exaggeration: By his sophomore year, he independently developed a full-stack pool cleaning robot. At 28, he received the First Prize in the National Defense Science and Technology Progress Awards. By 35, he attained the rank of senior engineer. He has secured three consecutive championships at the China Robot Competition and was honored as a “Young Scientist for a Maritime Power.” To date, he boasts 18 years of hands-on experience.

From an investment perspective, Chen Xiaobo possesses a rare quality: he not only immerses himself in research, demonstrating both academic and engineering prowess, but also possesses a keen understanding of commercialization.

During his combined master's and doctoral studies, he was sent on a government scholarship to the University of Melbourne to study multi-agent systems, researching control and decision-making for multiple robots and autonomous agents. “Europe had already begun using unmanned vessels for transport between islands and reefs at that time. In contrast, while many domestic universities ranked first globally in metrics, there remained a significant gap in industrialization compared to overseas counterparts,” Chen Xiaobo explained to me. It was precisely this experience that prompted him to step out of the ivory tower and embark on serial entrepreneurship. He first pursued an internal startup within a listed company, then partnered with others to launch ventures, consistently focusing on underwater robotics.

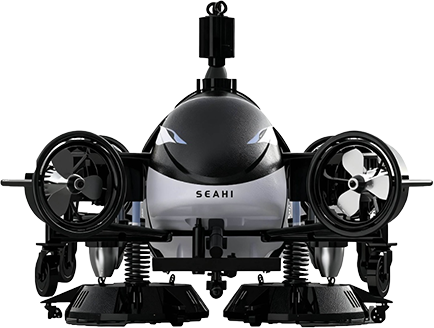

In 2023, he founded Seahi Robotics to tackle this challenging field. His commercial acumen accelerated Seahi's product development and deployment. Globally, few companies achieve mass production and delivery of underwater robots. Within just two years, Seahi has launched three product lines, including the “Orca” underwater cleaning robot, which has been commercially operational for over a year. The company doubled its revenue last year.

Beyond its founder, Seahi's core team primarily hails from research institutions and organizations with disciplinary strengths, including Harbin Engineering University, the Ministry of Water Resources, and the Chinese Academy of Sciences.

From a technical and product perspective, the underwater environment is highly complex, placing far greater demands on robots in terms of watertightness and control algorithms than their land-based counterparts. Chen Xiaobo spearheaded the development of China's first commercial underwater cleaning robot and the nation's inaugural surface unmanned vessel. The company now holds over 150 intellectual property rights related to underwater robots, intelligent vessels, and other technologies.

Most underwater developers focus on pool cleaning and light applications in calm or low-sea-state conditions. For instance, the swimming pool robot niche has become a crowded startup sector, attracting substantial angel funding exceeding 100 million yuan in recent years. Yet within the broader marine landscape, this segment barely covers 1% of the potential.

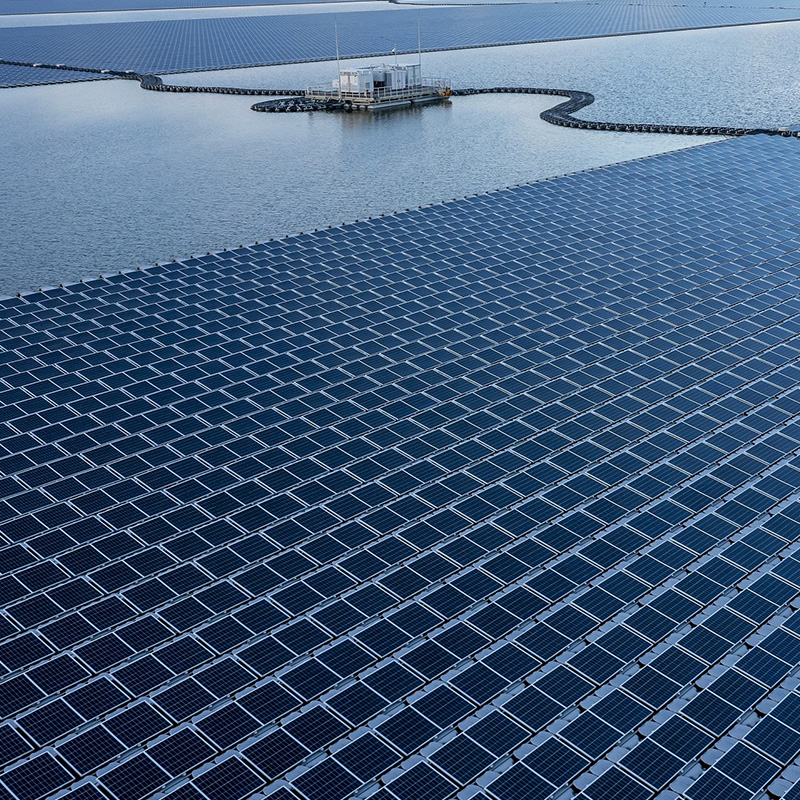

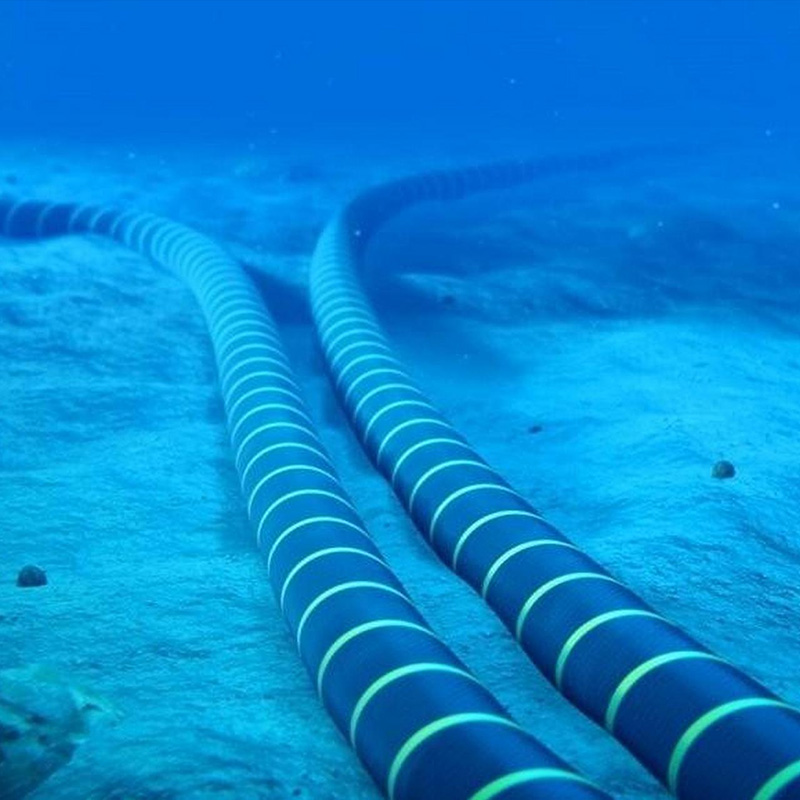

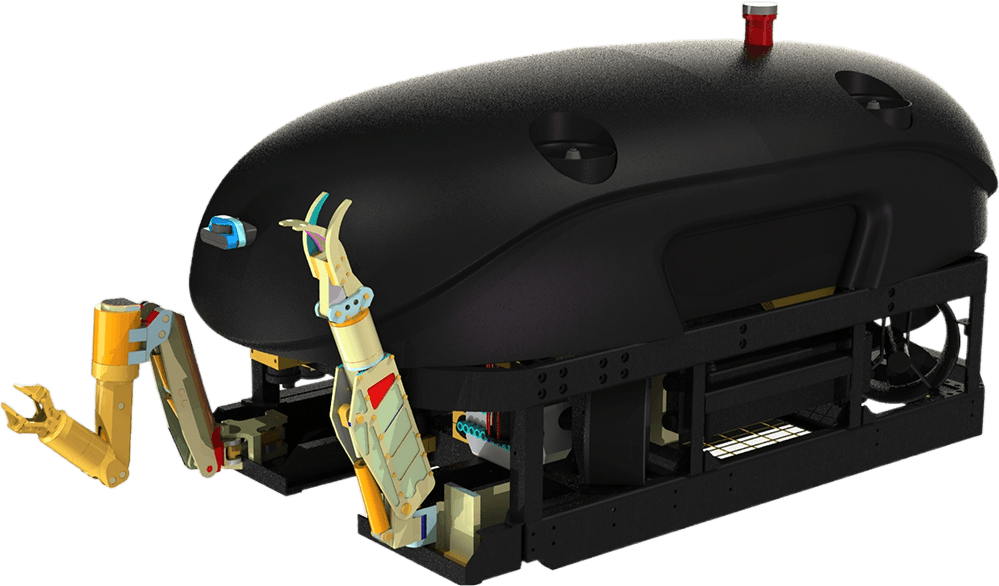

The ocean's typical environment involves waves, currents, swells, high salinity, high pressure, and high corrosion. Operating in such conditions demands underwater robots to achieve stable, high-speed, and fully-maneuverable performance—a naturally high technical barrier. To overcome this, Seahi has independently developed six core systems: propulsion, control, sensing, navigation, waterproof sealing, and deployment systems, alongside a full-degree-of-freedom attitude control algorithm. This enables operation in sea states of 3 Beaufort or higher with strong current resistance. The robot pushes the boundaries of depth, range, endurance, and harsh environments, capable of operating in oceans from 0 to 10,000 meters. It finds applications in multiple underwater scenarios including unmanned vessels, transportation, cleaning, resource exploration, and infrastructure maintenance.

Take one small detail: in the past, many underwater robots were designed as boxy shapes because this made them easier to stack. However, Seahi considered the application level and designed the robot with a streamlined shape, reportedly reducing cross-sectional drag to just one-tenth that of foreign competitors.

Simultaneously, Seahi's underwater robots feature scene adaptability and real-time AI modeling capabilities. While Seahi previously focused on solving issues related to the robot's physical structure and localized small-scale models, today's popular large models have endowed robots with generalized operational capabilities. Their advantage lies in the massive volume of underwater marine operation data accumulated over the years. By training on this data, generalized robots can be modularly adapted for diverse tasks like cleaning and detection.

Many robotics companies today find themselves looking for nails to fit their hammers. In contrast, Seahi's underwater robots have clearly defined application scenarios.

Traditional ship cleaning methods have obvious drawbacks: divers working underwater are often called “water ghosts” or “frogmen,” and this profession has an extremely high accident rate, with many risking their lives on the job. Chen Xiaobo, who has personally cleaned over a hundred ships, understands the hardships involved. Moreover, a single cleaning service costs tens of thousands of dollars, making it prohibitively expensive. This is precisely a classic scenario for replacing human labor with underwater operations, and customers are already willing to pay for it. Chen Xiaobo revealed that Seahi is the only underwater robot in China capable of commercial cleaning, having established partnerships with ports like Qingdao, Yantai, and Tianjin. Its ship cleaning business has grown tenfold annually. As a pioneer, Seahi also spearheaded the development of industry standards for underwater robot cleaning.

Amid this robotics boom, what may determine a company's trajectory is the founder's understanding of robots. Some view them as tools, others as toys, but Chen Xiaobo prefers to see them as “productivity enhancers.”

From this productivity perspective, Chen has summarized the “Three Laws of Robotics”: 1. Perform tasks humans cannot or are extremely dangerous to undertake; 2. Tackle tasks where human efficiency is low (achieving at least 10x efficiency); 3. Perform tasks where human labor is costly (reducing costs by at least 50%). If two of these criteria are met, the task is viable. Meeting all three indicates a strong, essential need—ship cleaning exemplifies this scenario. Meeting only one suggests a pseudo-need (where technological iteration must reduce costs and increase efficiency to at least meet two criteria before market viability). Failing to meet any of the three points signals a bubble.

Regarding the oceans, Chen Xiaobo observes that while people often speak of the vastness of the stars and seas, many explore space and the skies, giving rise to numerous outstanding companies. Yet few venture to explore the oceans. “The oceans cover 70% of the Earth's surface, but currently, humanity has developed only 1% of marine resources.”

Turning to China, its coastline spans 32,000 kilometers, ranking among the top five globally. It leads the world in annual shipbuilding output and shipping volume. Seven of the world's top ten ports are in China. From 2021 to 2024, the central government, State Council, and various ministries have introduced multiple policies to foster new marine productivity. Yet currently, China's self-sufficiency rate for core high-end marine engineering equipment remains below 5%. From this perspective, underwater robots represent a super productivity force within the marine economy.

After discussing the project, I couldn't resist concluding with a mention of General Manager Zhu. The release of our previous interview immediately sparked a clash of differing viewpoints. Everyone knows General Manager Zhu is articulate and outspoken, but I believe the matter is far more complex than it appears on the surface.

Viewpoints, like a mirror, clearly reflect each person's unique character traits. In the circles where Zhu Xiaohu operates, most investors exercise extreme caution when speaking publicly, driven by considerations of professionalism and safety. They weigh their words repeatedly, avoiding any expressions that might spark controversy or offend others, striving for every statement to be meticulously crafted and flawless. Against this backdrop, Zhu Xiaohu's remarks consistently stand out for their directness—sometimes sharp—and unmistakable personal stance. Yet they often leave observers puzzled: what exactly motivates him to publicly voice opinions that appear extreme or nonconformist?

Of course, much of his logic is transparent—frequently championing portfolio companies, occasionally taking jabs at competitors, and leveraging media to amplify his voice when needed, fueling the competitive narrative. Since GSR Ventures adheres to classical VC tactics—small teams, restrained scale—the individual becomes the team. Reputation is currency, and words are tools. But other aspects are less straightforward. For instance, why openly criticize industries they deem unworthy of investment? Simply avoid them. Take blockchain in 2018, large language models over the past two years, and the current hype around humanoid robots—the ripples of their words still linger.

Perhaps, as he suggests, articulation serves as part of a screening mechanism. A rational economist's reasoning might be: even if it alienates some unimportant individuals, clearly expressing preferences to attract like-minded partners enhances investment efficiency—making it the right choice. For instance, Chen Xiaobo views Zhu Zong as an exceptionally “transparent” investor. Alternatively, it could stem from emotion. Given that GSR Ventures is severing ties with Zhang Yutong, pouring cold water on projects backed by this former managing partner who violated his “fiduciary duty” is understandable. When he divested from ofo and later lambasted Zhang Yutong, “fiduciary duty” was the banner he waved.

I'll venture a bold hypothesis: what a self-proclaimed conservative dislikes most is a rebel who can't distinguish between primary and secondary matters. Of course, defining what's primary or secondary often becomes the root of conflict between old and new—a point we won't delve into here. Or perhaps, at certain moments, he simply can't resist stepping forward, acting like a child, to expose what he sees as the emperor's new clothes.

The real reasons are likely far more complex, with each situation being the result of multiple intertwined factors. Only Zhu Xiaohu himself truly understands the underlying causes. The beauty of Mr. Zhu is that if you ask, he will answer—but the true intent behind his words remains forever hidden in the secret corners of his heart.

Finally, let's see how the investors evaluated Seahi Robotics this time:

China Merchants Qihang: We highly recognize the outstanding innovation and execution capabilities of the Seahi Intelligent team. Their advanced training at a leading offshore engineering institution, independently developed intelligent vessel and robotics technologies, integrated surface-subsurface product portfolio, and pragmatic yet ambitious market expansion strategy collectively demonstrate exceptional comprehensive strength. Seahi Intelligent's business scope aligns perfectly with the development direction of China Merchants Group's transportation and logistics sectors, opening vast potential for future collaboration.

Golden Sand River Ventures: Human exploration of the oceans remains in its infancy, with complex underwater environments—particularly the deep sea—urgently requiring robotic solutions to replace human labor. Leveraging deep technical expertise and robust engineering experience, the Seahi team has overcome core technological barriers in underwater robotics. Their products have achieved commercial deployment across multiple scenarios, including underwater cleaning. We firmly believe Seahi will establish itself as a benchmark for new marine productivity through proprietary technologies, pioneering a trillion-dollar blue ocean in the marine economy.

Yunze Capital: The Seahi team completed systematic capability development prior to founding the company, with core members possessing over a decade of deep industry experience. Founder Dr. Chen, an authoritative industry expert, brings nearly twenty years of practical expertise that grants him forward-looking insights into industrial landscape evolution. His strengths lie particularly in precisely identifying clients' underlying needs and delivering systematic solutions. The current restructuring of the international trade landscape, coupled with the gradual refinement of global environmental regulations and carbon tax policies, is creating structural development opportunities for the marine economy. As shareholders, we will continue to empower Seahi Intelligent and jointly advance the implementation of the national strategy to build a maritime power and drive breakthroughs in industrial technological innovation. (Author: Liu Yanqiu / Source: ChinaVenture)