VC investors are seeking underwater robotics companies poised for commercialization.

VC Investor: “We're actively seeking companies like this.”

A “trillion-dollar opportunity”?

Author丨Li Man Source丨Dongshisiti Capital

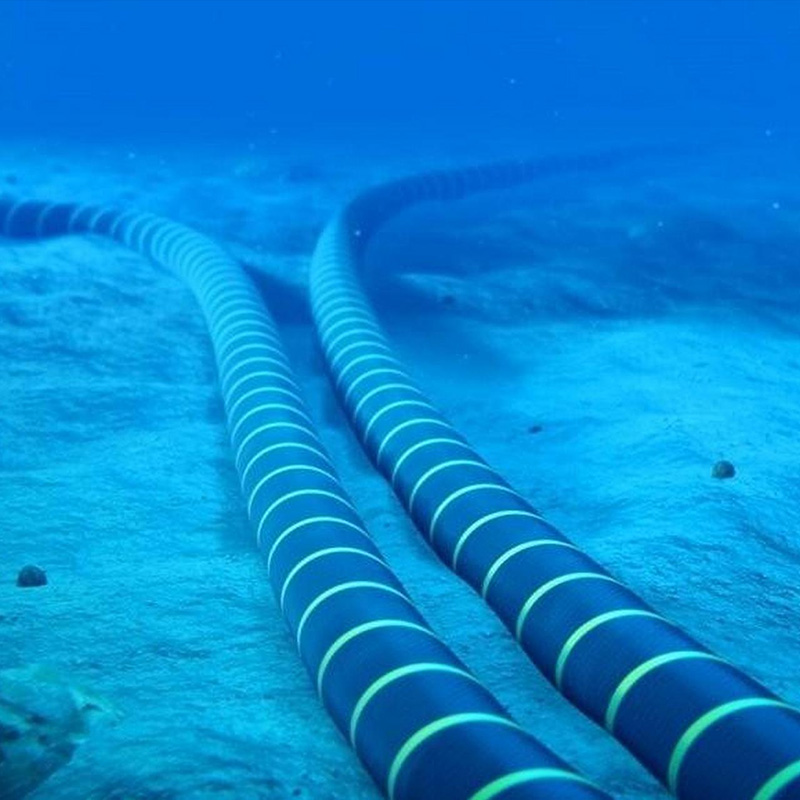

In May this year, Zhu Xiaohu, Managing Partner of GSR Ventures, made headlines with his latest move—despite having previously “declared pessimism about humanoid robots,” he exited multiple humanoid robot projects only to pivot and invest in an underwater robotics company, Seahi Intelligent (hereinafter referred to as Seahi).

At the time, observers interpreted Zhu's strategy: his exit from humanoid robotics stemmed from uncertain commercial prospects, publicly stating that such robots “serve only research or exhibition purposes without generating sustainable value.” His new investment, however, represented a “pragmatic move” toward companies with deep application capabilities and rapid commercialization potential.

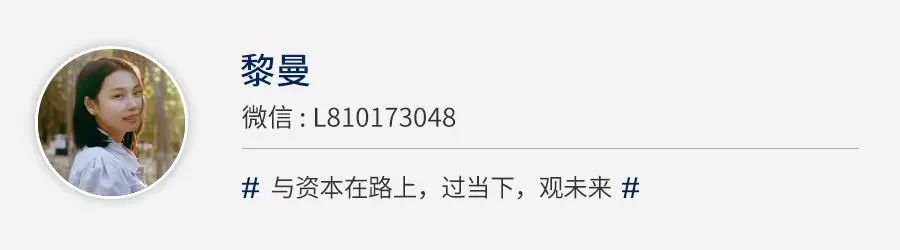

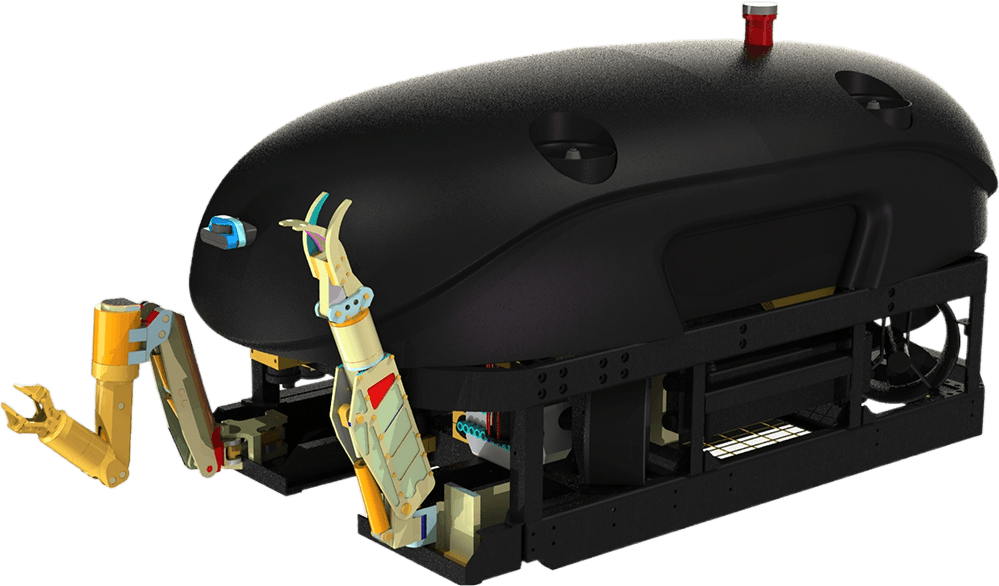

Founded in 2023, Seahi is China's earliest researcher and first company to commercialize underwater cleaning robots. Centered on versatile underwater robots, its “Orca” series products enable marine productivity from 0 to 10,000 meters, currently primarily deployed in ship cleaning applications.

“Is your product pushed underwater by a person?” Initially, the Seahi team faced considerable skepticism, with the founding team patiently explaining “absolutely not.” Recently, Cao Ying, Co-founder and COO of Seahi, shared: “This year, the company launched commercialization, achieving tenfold revenue growth, with profitability expected next year.”

Cao Ying revealed that the R&D costs for underwater scenarios are actually higher than those for humanoid robots in other scenarios. Within the broader robotics industry, it's uncommon for companies to achieve profitability within a year after significant R&D investments. What many may not realize is that Seahi's rapid commercialization is closely tied to its innovative business model—paying for AI results.

Specifically, shipowners pay a cleaning fee each time a vessel is cleaned. Their willingness to pay stems from the fact that cleaned ships not only replace manual cleaning—which cannot be verified—but also reduce fuel costs. “Ships cleaned by us save 100,000 yuan in fuel costs daily.”

This approach offers Seahi two major advantages: First, its product precisely addresses customer needs. Second, it eliminates revenue scale limitations. This model disrupts traditional industry revenue streams based on hardware sales, SaaS subscriptions, or integrated solutions.

Shihang is not alone. Numerous leading companies globally have embraced the “pay-for-results AI” business model era, which has become a consensus among today's global AI giants and major capital players.

At the closed-door session of the third Sequoia Capital AI Summit, which concluded this May, 150 top global AI founders—including Sequoia Capital Partner Pat Grady, OpenAI CEO Sam Altman, and Google Chief Scientist Jeff Dean—engaged in six hours of in-depth discussions, yielding numerous cutting-edge perspectives and shared insights. Among these, Outcome-based Pricing and Outcome-as-a-Service emerged as central concepts, signifying that “the next wave of AI will sell not tools, but outcomes.” Pat Grady termed this a “trillion-dollar opportunity.”

Domestically, like-minded institutions have already emerged. “We are actively seeking companies with this business model and will also encourage promising enterprises to transition in this direction,” stated Wang Xiangyun, Managing Partner at Shengjing Jiacheng Venture Capital. This pricing model has enabled some portfolio companies to achieve tenfold growth in revenue and profits.

Amidst the persistent warnings of an “AI bubble” within the venture capital community, a clearer path to commercialization has emerged. It is like a ray of light piercing through the chaos.

Why was it proposed?

In China, Shengjing was among the earliest institutions to propose this business model.

In March 2025, Shengjing introduced AI RaaS (Result-as-a-Service), an extreme outcome-driven model that boldly bases pricing, fees, and profitability on results. It vividly likened this approach to “AI property owners or AI clients,” asserting that only end-to-end services deeply embedded in the physical world can truly create value.

In fact, Seahi's business model was facilitated by Shengjing. At a business gathering, Seahi founder Chen Xiaobo met Peng Zhiqiang, Chairman of Shengjing Network and Founding Partner of Shengjing Jiacheng Ventures. Sharing aligned perspectives and values, Seahi adopted Peng's advice early on to adopt a results-based payment model, subsequently securing angel investment from Shengjing.

The team conducted financial projections to determine whether to offer equipment or deliver outcomes. “Ultimately, we concluded that delivering outcomes was the optimal solution. The number of applications could be scaled infinitely, leading to infinitely greater results. For clients, which decision carries higher costs—spending 100,000 yuan to clean a ship once, or investing millions in machinery? Clearly the latter,” recalls Cao Ying.

This occurred in 2023—a year marked by both boundless opportunities and a harsh capital environment. Chen Xiaobo, a scientist in his early 30s at the time, had already spent 18 years exploring the world of underwater robotics. It was only after the business model proved viable that Seahi made his investment earlier this year. Reportedly, Zhu's resources and capabilities helped Seahi break through, while Zhu boarded China's most promising underwater robotics project.

Why did Shengjing respond so quickly?

Wang Xiangyun explained that bottlenecks in the SaaS model drove this transformation. “During our last SaaS investment cycle, we observed that while the U.S. SaaS industry was booming with companies commanding high valuations, China's SaaS sector faced immense pressure and challenges across the entire value chain—from revenue generation and valuation to exit strategies.” In short: “The numbers just didn't add up.”

The team concluded that simply replicating the American model in China wouldn't necessarily work. Instead, software logic should be considered within the context of industrial internet and longer business chains. Following this logic, Shengjing has successfully invested in several companies.

Fast forward to 2022: Following ChatGPT's launch, a new AI-driven industrial cycle emerged. Shengjing observed that as foundational AI models iterated, the viability of “simple wrapper” applications would narrow. Thus, the long-term, sustainable capital value of such projects faced challenges. What capabilities must be strengthened to avoid being overtaken?

Shengjing's conclusion: companies must develop robust scenario capabilities and adopt outcome-based pricing. Investment cases reveal that outcome-driven pricing models can drive tenfold growth in revenue and profits. Beyond Seahi, Shengjing's portfolio includes Lingyun ZhiKuang—an AI-powered mineral exploration company.

To this end, Shengjing Research Institute has been publishing articles and launching the “AI RaaS Global Case Studies 30” series, systematically dissecting leading enterprises to provide local entrepreneurs with replicable models.

This approach has gained traction among many investors. Veteran investor Yunke also shared with me: The SaaS model is highly likely to come to an end in the AI era, driven by two key logics:

First, the payment logic has changed. The essence of SaaS is having users pay for tools, but tools are merely means—they don't solve the ultimate problem. AI, however, can directly replace labor, making this a market far larger than SaaS.

Second, the highest-quality AI models are closed-source, controlled by tech giants. New-generation SaaS built around these models can hardly establish a moat.

Currently, Yunke is also seeking out such enterprises with commercial potential.

What are the criteria?

Many may wonder: What exactly is the metric for AI agents that charge based on results?

Take Seahi as an example. Cao Ying admits that the company must gradually prove its value and educate the market through tangible operational outcomes, such as fuel savings for clients. This process is challenging.

Cao Ying concludes that successfully implementing a “pay-for-results” business model ultimately hinges on three core capabilities:

First, unparalleled hardware and system integration capabilities. Second, the “fuel” for continuous iteration and barrier-building: by cleaning “thousands of vessels,” they've accumulated operational data across diverse ship types (bulk carriers, container ships, etc.), maritime regions (North Sea, East China Sea, South China Sea), water qualities, and seasons. This is unattainable for companies solely selling equipment or lacking direct end-user engagement; third, quantifiable and verifiable service outcomes.

Currently, Seahi holds the largest repository of underwater scenario data in China. “Latecomers will struggle to catch up.” However, Cao Ying also noted that during the business model validation phase, the company essentially “competed fiercely domestically while generating profits overseas.”

On one hand, domestic shipowners are highly price-sensitive and tend to opt for the lowest-cost solutions, even when service quality varies significantly. In overseas markets like Japan and Singapore, where labor costs are higher, there is greater recognition of the value of technology and willingness to pay premium prices. Overseas customer order values can reach over three times those in China, prompting the company to actively expand into international markets.

Globally, the RaaS model is being implemented across multiple sectors. Companies like Clay, Sierra, and 11X have evolved from traditional software subscriptions to task-based billing or hybrid pricing models tied to both tasks and outcomes.

Sierra, the AI customer service unicorn founded by OpenAI board chair Bret Taylor, stands out for its aggressive approach. It's not merely a customer service system but a closed-loop sales agent platform that helps brands complete the entire sales journey—from initial inquiry to order placement.

It not only engages customers but also drives conversion outcomes, truly adopting the “give me a budget, and I'll deliver GMV” approach.

One detail illustrates this clearly: When an AI agent independently resolves an inbound call or online inquiry, Sierra charges a fee; if human intervention is ultimately required, that interaction is free.

“We really like this model, and I believe it will become the standard business model for intelligent entities,” Bret Taylor stated. Founded in 2023, Sierra has now transformed into a unicorn valued at over $10 billion.

Ramp takes this concept to its extreme. Founded in New York in 2019, this fintech company started with a corporate credit card, aiming to disrupt traditional corporate expense management through technology to save businesses time and money. Instead of selling a financial system, it directly promises cost savings. Its AI automatically identifies redundant subscriptions, negotiates discounts, and predicts risks, turning “the benefits of using this tool” into a KPI.

To summarize a more universal metric for “outcome-driven products,” Sequoia Capital outlined three criteria at its closed-door summit: whether it can complete an entire task workflow; whether it maintains persistence during task execution; and whether it delivers measurable business value.

In the view of the Shengjing team, the adoption of this model is a gradual process, which can be categorized into four levels based on intelligence: L1 to L4.

L1 represents short-process operations primarily conducted through online digital applications, characterized by high repetition, clear workflows, and a high degree of standardization. These are typically the first to be implemented in industries such as legal services and customer support. L2 often involves lengthy operational processes requiring complex reasoning, tool invocation, and integration, frequently necessitating the use of hardware tools for implementation. L3 focuses more on helping clients achieve closed-loop sales of products and services, ultimately sharing in the resulting revenue—signifying a qualitative leap in AI services' outward-facing connectivity capabilities. L4 ascends to “AI owner” status, not only possessing AI service capabilities but leveraging AI advantages to become the core asset or the primary/partial “owner” of the company's value.

Wang Xiangyun believes that higher-level intelligent operations will require high-quality collaboration between AI and highly skilled professionals for an extended period—a healthier model for AI industrialization. As technology matures, AI's proportion will gradually increase. In terms of overall advancement speed, supply chains and value chains with higher marketization levels will accelerate the adoption of AI RaaS more rapidly.

AI blue oceans and bubbles can both be true simultaneously.

AI agents emerged as large AI models were being deployed in practical applications, placing them squarely within the broader debate surrounding the “AI bubble.”

In the second half of 2025, the AI capital market recorded its worst performance since April this year, with the Nasdaq index plunging over 3% in a single week—further fueling broader discussions about the AI bubble.

The core issue lies in the stark contrast between massive R&D investments and commercial revenue for leading companies like OpenAI: in 2024, its R&D expenditure exceeded $15 billion, yet commercial revenue fell short of $3 billion.

Even if annual revenue reaches $20 billion by the end of 2025 as Altman projected, and grows to hundreds of billions by 2030, achieving positive cash flow remains challenging.

Meanwhile, AI cost issues are increasingly evident. The expectation that large model costs would decrease tenfold annually failed to rescue the subscription-based business models of many AI companies.

A study from MIT has also sparked widespread discussion, pointing out that despite companies having invested $30–40 billion in generative AI, 95% of organizations have yet to see any business returns.

However, Yunke emphasizes that one key logic must not be confused: "The general-purpose large models themselves and monetizing their capabilities are two separate matters. The former requires massive investment and inevitably yields no short-term returns. Their purpose isn't rapid profitability but securing strategic high ground in the next technological revolution. This is a game only a select few national teams and tech giants can afford to play. The latter is where ordinary entrepreneurs should focus their efforts."

He believes humanoid robots are an overhyped area this year. “This field is still rapidly evolving, and we may see breakthroughs in the coming years. But expecting rapid, large-scale deployment is, in my view, a significant overestimation. Technological development must progress through several stages; it cannot be skipped. As we've seen, even Tesla has lowered its production expectations for Optimus this year.”

So, how should we view the current bubble?

Perhaps we can draw on a clear yet nuanced answer given by Sierra co-founder and CEO Bret Taylor in an interview:

AI will reshape the economy and create immense value; at the same time, bubbles do exist, and some will lose a lot of money. Both can be true simultaneously.

He believes the current AI bubble closely resembles the dot-com bubble: While the dot-com era saw numerous failures, extending the timeline to 30 years reveals the emergence of giants like Amazon and Google, Microsoft's cloud business becoming a cornerstone of its market value, and the profound impact of the internet on global GDP—much of the “optimism” in 1999 was fundamentally aligned with the right direction. Even ventures like Webvan (online grocery delivery) have reemerged in healthier forms—as Instacart and DoorDash—following smartphone adoption and internet maturity. Many ideas weren't flawed; they simply arrived too early.

Furthermore, the exploration of paying AI agents based on outcomes will gradually become a new trend in AI monetization.

Overall, by 2025, AI agents will have moved beyond proof-of-concept in multiple industries, entering a phase of value realization. Amid discussions about an AI bubble, the emergence of the RaaS (Robotics-as-a-Service) model points the industry toward a pragmatic development path—AI technology must return to its commercial essence and create measurable value for customers. This path may not be as flashy as unlimited funding or stacking computing power to chase SOTA (State-of-the-Art), but it may prove more enduring and robust.