Led by Unicorn Hunter, this underwater robotics company has secured two consecutive rounds of financing totaling 50 million yuan.

During this year's “capital honeymoon period” when humanoid robotics companies secured substantial funding with ease, Peter Zhu, Managing Partner at GSR Ventures, publicly stated that the firm was “exiting humanoid robotics in bulk.” Shortly thereafter, GSR shifted its focus to an underwater robotics company, participating in its Pre-A round financing.

Known in investment circles as the “unicorn hunter,” Zhu is celebrated for his strategy of “investing amid controversy and exiting during euphoria.” Does GSR Ventures' entry signal that underwater robotics is poised to become the next blue ocean and hot trend?

Tech Leaders Take the Lead

Targeting Commercialization of Aquatic Robots

On May 16, Seahi Intelligent announced the successful completion of its Angel+ and Pre-A financing rounds, raising a total of RMB 50 million. The Angel+ round was led by China Merchants Group's China Merchants Qihang Capital, while the Pre-A round was co-led by GSR Ventures and Yunze Capital, with participation from Kunshan Angel Fund, Wuzhong Financial Holdings, and Anyu Capital.

Founded in March 2023, Seahi Intelligent is a technology enterprise specializing in the independent R&D, production, sales, and service of aquatic robots and intelligent unmanned equipment. (Note: Aquatic robots include underwater robots, surface robots, etc.)

The team at Seahi primarily consists of members from Harbin Engineering University, the Ministry of Water Resources, the Chinese Academy of Sciences, and other research institutions and organizations with disciplinary strengths. They have accumulated extensive experience in unmanned system technology, the military industrial market, and the field of intelligent aquatic equipment. Founder Chen Xiaobo has dedicated 18 years to underwater robotics, spearheading over 20 major national defense research projects. He has been honored as a “Young Scientist of the Maritime Power” and received the “First Prize for National Defense Science and Technology Progress,” while securing three championships at the China Robot Competition.

Upon returning from overseas studies in 2016, Chen Xiaobo began advancing the technological upgrades and industrial applications of underwater robots.

Reflecting on his entrepreneurial motivation, Chen Xiaobo stated, “While our research projects achieved top-tier domestic and international technical benchmarks, they abruptly concluded upon completion without further industrialization. We still face significant gaps with foreign counterparts in commercialization and productization.”

In 2020, Chen Xiaobo's team launched commercial aquatic robotics products. By 2023, Seahi had officially established operations in Beijing and Suzhou, focusing on two core businesses: the research and development of unmanned aquatic equipment, and the maintenance of aquatic environments and assets.

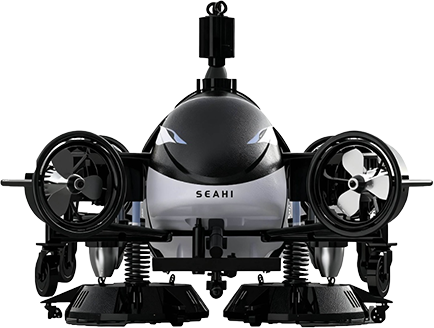

The company's products first found commercial application in underwater ship cleaning. Addressing challenges such as irregular surfaces, wave impacts, and limited positioning/communication capabilities, Seahi Intelligent independently developed six core systems: a high-resistance control system, a long-life high-reliability power system, a sensing system, a positioning system, a waterproof sealing system, and a propulsion deployment system. These systems enable stable, high-speed underwater operations while adapting to irregular surfaces and surge impacts. waterproof sealing systems, and powered deployment systems. This enables stable, high-speed, autonomous underwater operations despite irregular surfaces and wave surges.

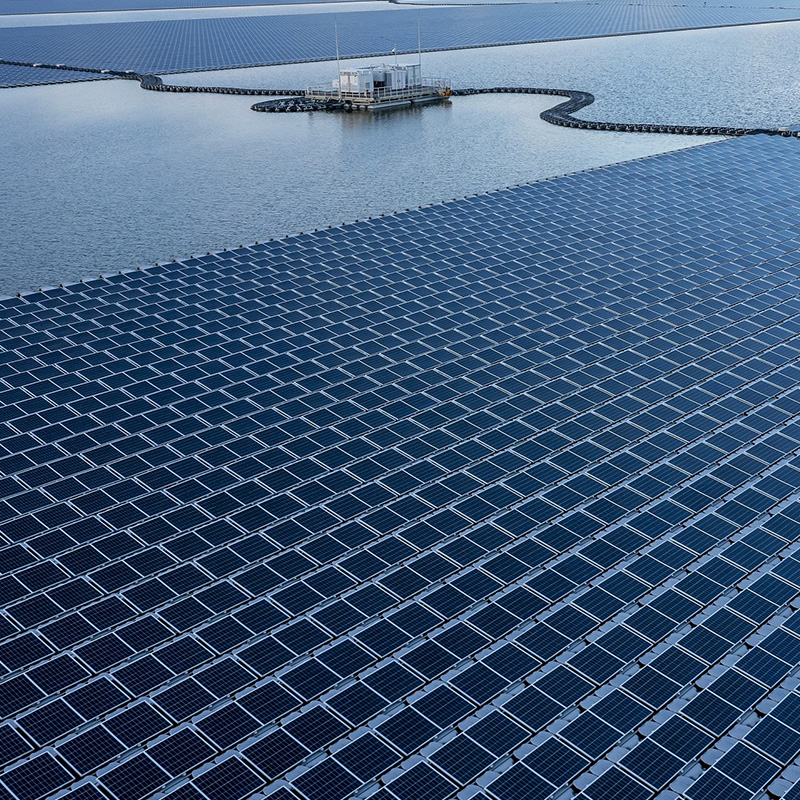

Currently, Seahi Intelligent has developed two flagship product series: the underwater robot “Orca” and the surface robot “Shark.” These are deployed across defense, emergency response, environmental protection, shipping, and water conservancy sectors. Commercialization has been achieved at depths ranging from 0 to 300 meters underwater. Clients include shipping enterprises such as COSCO Shipping, Guoneng Shipping, Huadian Engineering, China Merchants Group, and Seahi have also established partnerships with port groups including Qingdao Port, Yantai Port, and Tianjin Port.

Seahi Intelligent “Orca” Underwater Intelligent Inspection and Cleaning Robot

Additionally, Chen Xiaobo revealed that Seahi achieved double-digit revenue growth in 2024, with approximately half of its cleaning orders originating from overseas clients in regions such as Singapore and Thailand. The company plans to use Southeast Asia as a springboard to expand its business coverage to Europe, North America, and other regions in the future.

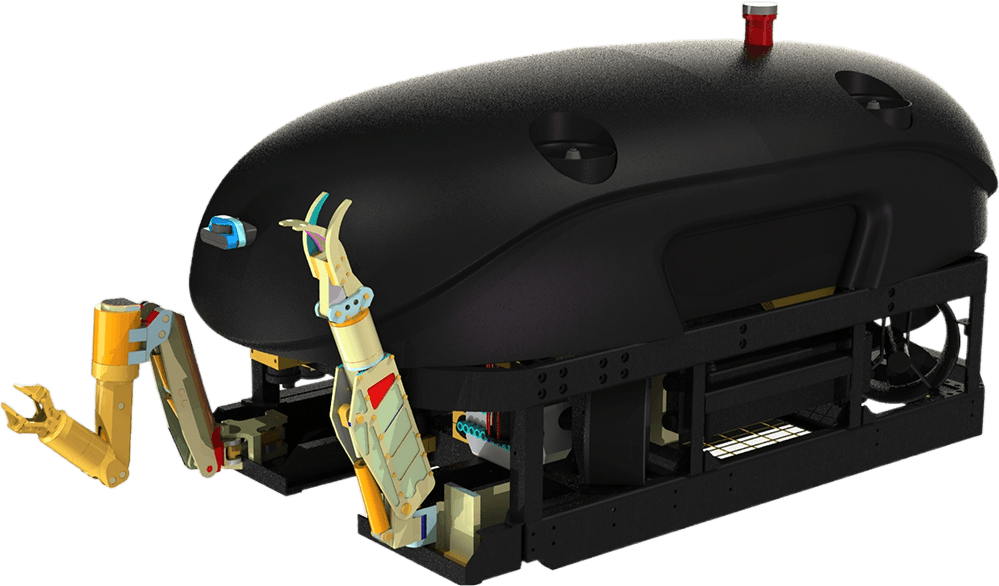

Regarding the company's future development direction, Chen Xiaobo stated that Seahi Intelligent's products are designed as versatile underwater robots, with different operational modules adaptable to a wider range of scenarios. Subsequent funding will be invested in technological advancements such as AI large models and deep learning, including R&D for the Ocean X series of deep-sea robots. This initiative aims to unlock super productivity across the entire spectrum from 0 to 10,000 meters of ocean depth.

Deep-Sea Technology Policy Catalyst

Domestic Underwater Robots Ride the Wave Forward

The 2025 Government Work Report first introduced “deep-sea technology,” positioning it alongside commercial aerospace and low-altitude economy as a national strategic emerging industry. Consequently, 2025 is widely regarded as the inaugural year for China's deep-sea technology sector, with related policies set to further catalyze the refinement and development of its upstream and downstream industrial chains.

Seahi Intelligent stated that China's self-sufficiency rate for core equipment in high-end marine engineering currently stands below 5%. Compared to terrestrial environments, the deep sea presents extreme conditions such as high pressure, low temperatures, and darkness, imposing exceptionally high demands on equipment materials, sealing technologies, and energy systems.

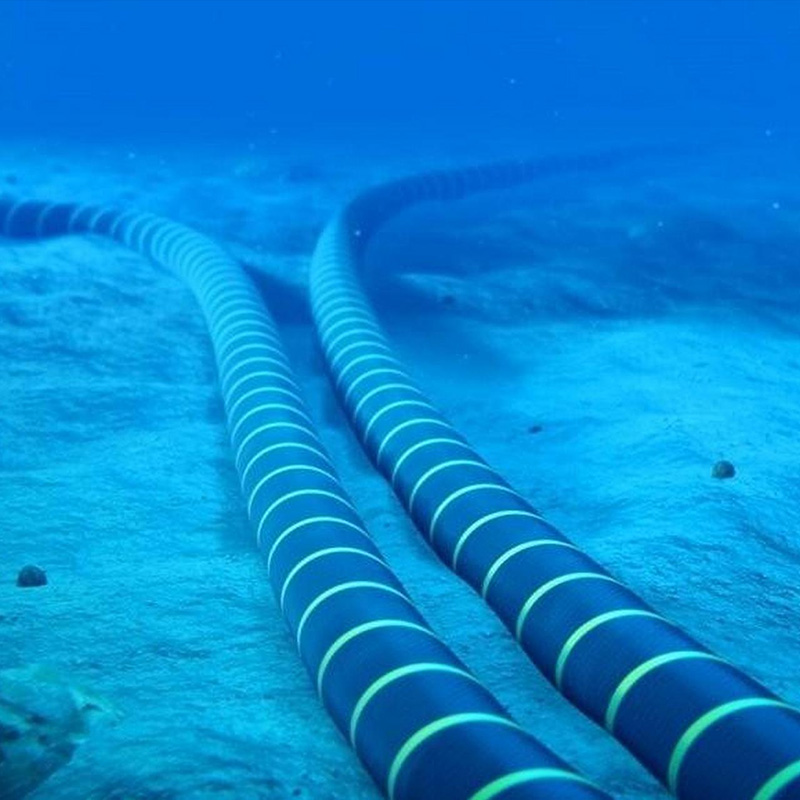

Traditional deep-sea operations suffer from time-consuming, labor-intensive, and safety-risk challenges. For instance, when laying pipelines at depths exceeding 200 meters, operators must rely on multi-purpose support vessels to deploy remotely operated underwater vehicles (ROVs) for mud point monitoring. This not only increases the risk of vessel cross-operations but also significantly raises pipeline laying costs.

As core equipment for marine resource development, underwater robots represent a super productivity force in the ocean economy. Product types primarily fall into two categories: remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs). ROVs rely on umbilical cables for power, offering strong operational capabilities and endurance, while AUVs navigate autonomously with self-contained energy sources, enabling large-scale exploration missions.

The underwater robotics industry features high entry barriers, historically dominated by technological monopolies from Western, Japanese, and Korean firms. However, domestic enterprises have accelerated their development in recent years, launching multiple autonomous underwater vehicle models capable of diving into deep-sea environments. These systems replace or assist humans in extreme operations, serving applications such as salvage and rescue, underwater exploration, and marine resource extraction.

After about a decade of development, domestic underwater robotics companies such as Seahi Intelligent, Boya Gongdao, ShenZhiLan, Shandong Future Robotics, FinSource Technology, CSSC Technology, Qianxing Technology, Robofly Marine, Yoken Robotics, and Hangzhou Aohai have actively pursued technological innovation. They have driven product upgrades in China's underwater robotics industry from various angles, accelerating the process of domestic substitution. Specifically:

Boyagongdao has transitioned from consumer-grade products to industrial applications through a tiered design approach. It has developed bionic underwater robots and industrial-grade ROVs with payloads ranging from 20kg to 3 tons, serving applications in pipelines, freshwater ecosystems, lakes, nearshore, and deep-sea environments.

DeepBlue pursues a dual-drive strategy for industrial and consumer markets, offering enterprises its ROV series (Jiangtuo/Houtuo/Haidun), Orange Shark AUV series, and underwater gliders. These serve sectors including offshore oil, marine wind power, scientific research, marine environmental surveys, underwater security, salvage operations, hydropower, and aquaculture. Meanwhile, SUBLUE—a consumer brand incubated by Sublue—adopts a global operational strategy. Its underwater boosters and pool robots have sold over 150,000 units across more than 70 countries worldwide.

Shandong Future Robotics operates across both deep-sea and shallow-water domains, offering underwater robots for deep-sea operations, underwater suspension, underwater cutting, deep-sea cable laying, and ship cleaning. Its independently developed 3,500-meter deep-sea operation robot achieves 100% domestic production of core components, overcoming technical challenges in deep-sea power transmission, communication, navigation positioning, and intelligent multi-equipment coordination.

In early May this year, Shandong Future Robotics secured hundreds of millions of yuan in Series A funding from CNPC Kunlun Capital. Its executives stated that this year's sales target is 400 to 500 million yuan, with some orders already booked through next year.

FinSource Technology focuses on integrating underwater robotics with cutting-edge AI technologies, developing products such as AI underwater robots, AI rapid underwater positioning systems, and AI intelligent underwater precision measurement systems. These span consumer-grade, underwater industrial-grade, and marine industrial-grade applications, serving sectors including aquaculture, emergency rescue, underwater security, shipyards and ports, infrastructure and bridges, wind power and energy, and photography/entertainment.

Beyond these early-stage players, companies like CRRC Group, Zendry Technology, and Dahua Technology have recently entered the field through in-house R&D and acquisitions, aggressively developing underwater robotics products and technologies.

Although the call to advance deep-sea technology toward “future industries” has been sounded, the domestic market for underwater robots and intelligent equipment remains fragmented overall. Low concentration levels have yet to generate clustering effects, and technological capabilities still hold room for improvement.

Industry insiders reveal that one reason for the slow development of domestic underwater robotics technology is the lack of an integrated, mature underwater robotics supply chain. Common components and accessories for land-based and aerial robots often lack sufficient resistance to water currents and corrosion. Most companies must either custom-order these parts or develop them in-house, requiring substantial investment in R&D and the construction of dedicated factories. This insider indicates that the supporting supply chain for underwater robots is poised to become a new commercial “blue ocean.”

Similarly, capital's investment in corporate funding, coupled with preferential support from local governments and national policies, alongside enterprises' independent R&D of core technologies and components, will form a powerful triad. This synergy will fuel an unstoppable super engine propelling humanity's exploration of the vast oceans. As commercial pathways become increasingly clear and early-mover companies see their order books bursting at the seams, it's evident that many capital entities—with their keen instincts—have already set their sights on this expansive frontier. They stand poised and ready, brimming with ambition.