Seahi Robotics Secures $5 Million Funding: After Zhu Xiaohu Shifts Focus Away from Humanoids, Underwater Robotics Emerges as New Capital Hunting Ground.

On May 15, 2025, Suzhou Seahi Intelligent Technology Co., Ltd. (hereinafter referred to as “Seahi Intelligent”) announced the completion of a combined 50 million yuan in angel+ and Pre-A round financing. The investor lineup has drawn significant industry attention. China Merchants Capital, a subsidiary of China Merchants Group, led the Angel+ round. GSR Ventures and Yunze Capital co-led the Pre-A round. Existing investor Kunshan Angel Fund continued its participation, while Wuzhong Financial Holdings and Anyu Capital also joined the investment. Notably, this investment in the underwater robotics sector by GSR Ventures—whose partner Zhu Xiaohu previously faced controversy for “massively exiting humanoid robotics projects”—may signal a strategic pivot by capital toward niche segments within the robotics industry.

Seahi Intelligent: Capital's New Darling Driven by Dual Forces of Technological Barriers and Scenario Implementation

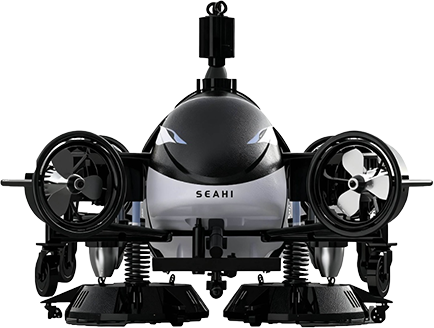

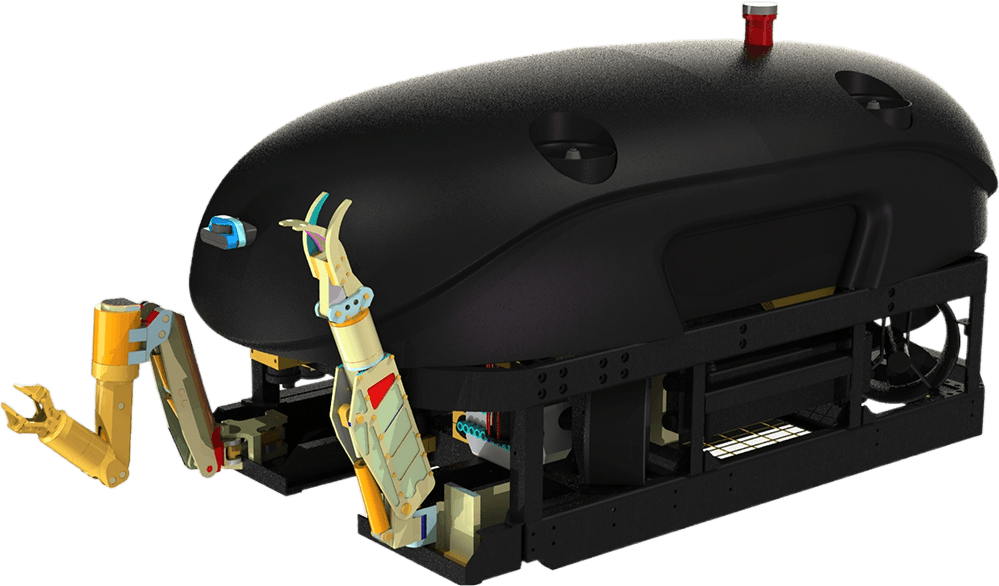

Seahi Intelligent was established in 2023, specializing in the R&D, production, and sales of general-purpose aquatic robots and intelligent equipment. Its core team comprises technical experts with academic backgrounds from institutions such as Harbin Engineering University and Northwestern Polytechnical University. Founder Chen Xiaobo was recognized as a senior engineer at age 35, honored as a “Young Scientist for a Maritime Power,” and received the First Prize for National Defense Science and Technology Progress at 28. His team possesses over a decade of technical expertise in specialized operation robots.

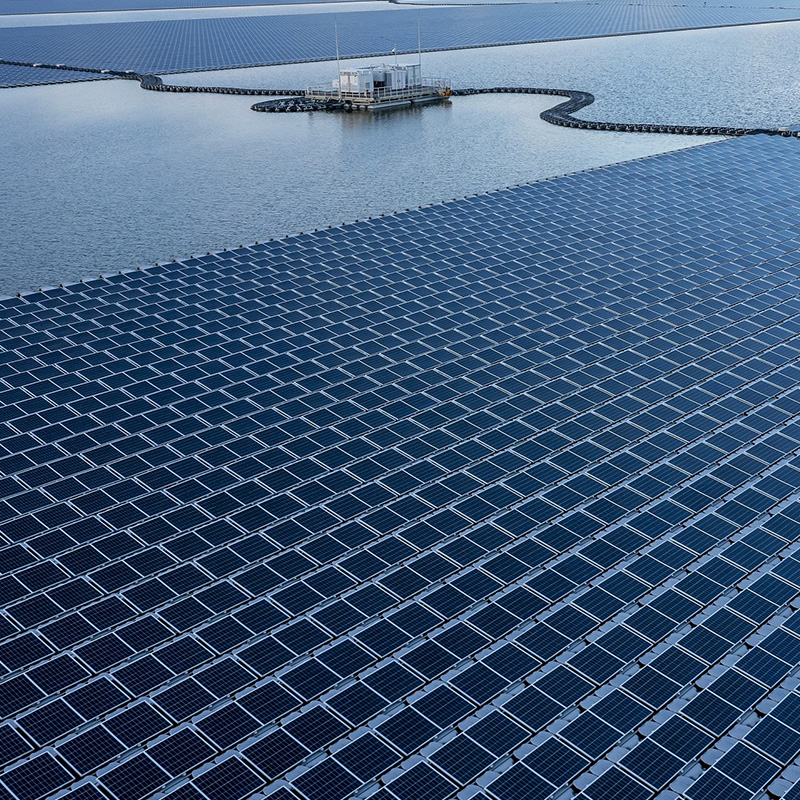

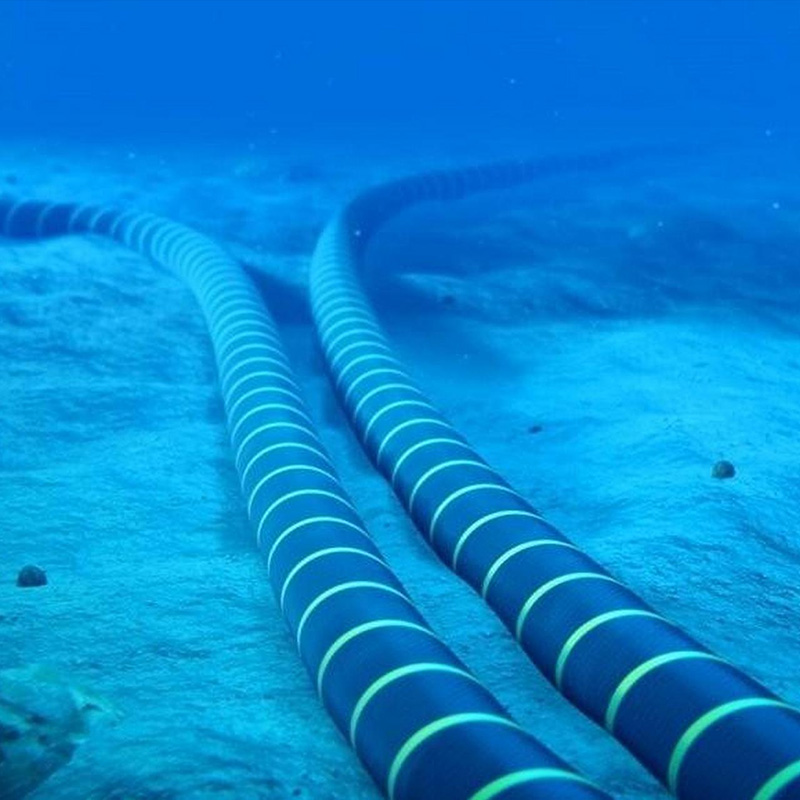

The company's flagship products target underwater cleaning and marine engineering equipment applications, achieving commercial deployment. For instance, its underwater robots replace manual labor in high-risk tasks like ship hull rust removal and subsea pipeline inspection, establishing technological barriers in smart ports and green shipping sectors. Unlike humanoid robotics—still transitioning from lab to industry—Seahi Intelligent's mature technology and scenario adaptability have become key factors attracting capital investment.

Lead Investor's Strategic Layout: Synergy Between Industrial Collaboration and Policy Dividends

China Merchants Capital, as the early-stage investment platform under China Merchants Group, aligns its lead investment strategy closely with the group's core businesses. China Merchants' resource advantages in shipping, ports, and other sectors complement Seahi Intelligent's marine engineering equipment. For instance, Seahi Intelligent's underwater robots can be deployed for vessel maintenance at China Merchants-owned ports, reducing labor costs and enhancing operational efficiency.

The joint lead investment by GSR Ventures stands in stark contrast to its earlier stance of “exiting humanoid robotics.” Zhu Xiaohu had publicly questioned the commercial viability of humanoid robots, stating that “customers only use them for research or demonstrations, failing to create sustained value.” In contrast, Seahi Intelligent's “surface + underwater” product portfolio and its focus on essential scenarios in specialized operations may better align with GSR's “pragmatic investment” philosophy. Yunze Capital emphasized that the Seahi team had built systematic capabilities before founding the company, demonstrating particular strength in precisely identifying customer needs.

The Dilemma of Humanoid Robots: Technical Bottlenecks and Commercialization Paradoxes

Zhu Xiaohu's remarks on “exit” directly address the pain points of the humanoid robot industry. Currently, 45% of the world's humanoid robots originate from China, yet most companies still face the dual challenges of “insufficient technological maturity” and “lack of commercial application scenarios.” For instance, while a leading company has announced mass production plans, its products are primarily deployed in universities, research institutions, and reception/performance settings, failing to achieve large-scale implementation in industrial environments.

A report by the Gaogong Robotics Industry Research Institute indicates that widespread adoption of humanoid robots requires addressing two major issues: First, functional completeness must meet demands for high-precision operations and intelligent mobility. Second, cost control is essential, as current unit costs remain prohibitively high for broad market acceptance. Furthermore, the absence of industry standards leads to inconsistent product designs, further hindering commercialization progress.

Underwater Robotics: Structural Opportunities in a Blue Ocean Market

Compared to the fiercely competitive “red ocean” market in humanoid robotics, the underwater robotics sector is poised for structural opportunities. The restructuring of international trade patterns coupled with increasingly stringent global environmental regulations is driving surging demand in the marine economy. Seahi Intelligent's “surface + underwater” product portfolio spans specialized industries, environmental safety, hydropower, and other sectors, creating a differentiated competitive advantage.

Sand Hill Ventures noted that human exploration of the oceans remains in its infancy, with complex underwater environments urgently requiring robotic solutions to replace manual labor. Leveraging deep technical expertise, the Seahi team has overcome core technological barriers in underwater robotics, achieving commercial deployment in applications such as underwater cleaning. China Merchants Venture Capital highlighted that Seahi's business direction aligns strongly with the transportation and logistics segment of China Merchants Group, indicating substantial potential for future collaboration.

Behind the Shift in Capital: From “Hot Trend Chasing” to “Value Investing”

Zhu Xiaohu's “shift in focus” may reflect capital's reassessment of the robotics sector. On one hand, inflated valuations and unclear commercialization paths in humanoid robotics have led early-stage VCs to pull back. On the other, niche areas like underwater robotics—with their technological maturity and scenario adaptability—have become capital's “safe-haven” choice.

Yunze Capital analysis indicates that the current restructuring of international trade patterns, coupled with the refinement of global environmental regulations, is creating structural opportunities in the marine economy sector. As a practitioner of China's national strategy to build a maritime power, Seahi Intelligent's technological self-reliance and market expansion capabilities align with capital's investment preferences for “hard technology.”

Chen Xiaobo, founder of Seahi Intelligent, stated that this funding round will accelerate core technology R&D and market expansion, strengthening the company's application advantages in military and emergency response sectors. The company plans to advance the localization of intelligent equipment across all aquatic domains under the mission of “combat readiness in wartime, emergency response in crises, and public service in peacetime,” thereby contributing to China's maritime power development.

From an industry perspective, the underwater robotics sector remains in its blue ocean phase. According to market research forecasts, the global marine robotics market is projected to exceed $10 billion by 2030, with underwater operational robots accounting for over 60% of this market. The rise of Seahi Intelligent may offer capital a new pathway to transition from the “humanoid robot bubble” toward “hard technology value investing.”

Amidst the controversy surrounding Zhu Xiaohu's “exit from humanoid robotics,” Seahi Intelligent's funding case reveals a rational return to the capital market. As the robotics sector shifts from “hot trend chasing” to “value investing,” technological barriers, scenario adaptability, and commercialization capabilities will become the core metrics for evaluating a company's potential. The underwater robotics niche, in particular, may be standing at the starting point of a new wave of industrial explosion.